Table of Content

- How much tax benefit can I claim on home loan interest for rented property?

- Can I claim tax benefits on two home loans?

- How to claim Income Tax Benefits on Second Home Loan?

- Join Taxguru’s Network for Latest updates on Income Tax, GST, Company Law, Corporate Laws and other related subjects.

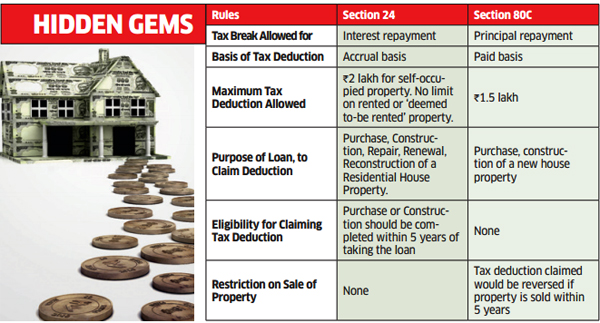

- Is Tax Benefit on Second Home Loan allowed?

Apply for an online payment agreement (IRS.gov/OPA) to meet your tax obligation in monthly installments if you can’t pay your taxes in full today. Once you complete the online process, you will receive immediate notification of whether your agreement has been approved. Although the tax preparer always signs the return, you're ultimately responsible for providing all the information required for the preparer to accurately prepare your return. Anyone paid to prepare tax returns for others should have a thorough understanding of tax matters.

Also, don't use these payments to reduce other deductions, such as real estate taxes. The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business, investment, or other deductible purposes. Otherwise, it is considered personal interest and isn't deductible.

How much tax benefit can I claim on home loan interest for rented property?

In an instant case Sale Consideration of Flat is 52 Lacs, Stamp Duty Value is 45 Lacs. Can deduction under Section 80EEA be taken in this case as the Stamp Duty Assessable Value is exceeding 45 Lacs but Stamp Duty Value by itself is not exceeding 45 Lacs. Yes, subject to the actual amount of interest and principal paid in aggegate.

This option is available to only those property owners who are generating income from the house property. Apart from the rebate on principal repayment per Section 80C, a reduction for custom duties and fees of registration can also be done in inclusion to the reduction for principal compensation, but up to total of Rs 1.5 lakh. If this is the case, you won’t be qualified to reduce interest on a housing loan until the property construction is done or when you buy a house that is been constructed already. These articles, the information therein and their other contents are for information purposes only.

Can I claim tax benefits on two home loans?

However, this rebate will not be available if the property is self-occupied, since such properties do n0t have any net annual value under the existing tax laws. Yes, you will be able to enjoy tax rebates under Section 80C as a co-owner on the second home loan. These deductions will be available on the stamp duty you paid in that year or the principal portion of the loan.

Because $15,000 is the smaller of items 1 and 2, that is the amount of interest Don can allocate to his business. You figure the total amount of interest otherwise allocable to each activity by multiplying the amount on line 13 by the following fraction. 535 for an explanation of how to determine the use of loan proceeds. Multiply the amount in item 1 by the decimal amount on line 14. Enter the result on Schedule A , line 8a or 8c, whichever applies. If you have home acquisition debt incurred after December 15, 2017, go to line 7.

How to claim Income Tax Benefits on Second Home Loan?

Go to IRS.gov/IdentityTheft, the IRS Identity Theft Central webpage, for information on identity theft and data security protection for taxpayers, tax professionals, and businesses. If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, you can learn what steps you should take. Make a payment or view 5 years of payment history and any pending or scheduled payments. Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services.

The information collected would be used to improve your web journey & to personalize your website experience. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest for the Current Year See the Table 1 Instructions.Qualified loan limit, Table 1. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest for the Current Year See the Table 1 Instructions.Wraparound mortgages, Wraparound mortgage.

If you have paid your home loan completely and there is no interest that is due on the second loan. In this case, you cannot claim the benefit and the rental value after the deduction of municipal taxes and standard deduction is added to your total income. Almost all banks offer online calculators that help borrowers arrive at the amount they can claim as income tax rebate.

I have claimed interest rebate of 1.5lc and principal rebate of 1lc in my previous year taxes. Under these provisions, if you want to deduct interest on a second home, you must have a mortgage on it. If you borrowed against the equity on your first home to finance the purchase of your second home, you can't deduct the interest. Like a mortgage, you can deduct interest on up to $750,000 in home equity debt if you are single or married filing jointly ($375,000 if married filing separately). This means you can deduct mortgage interest and property taxes as you would with any home. You can deduct rental expenses, but only up to the level of rental income (e.g., you can't claim rental losses).

However, Puri thinks it is unlikely that the Budget 2023 would revise the Section 80C limit. “Instead, we may see the Budget further incentivising MSMEs and SMEs that are still struggling post the pandemic,” he said. Puri believes there is an express need for more tax sops for home buyers as well as investors. “The Rs 2 lakh tax rebate on housing loan interest under Section 24 of the Income Tax Act needs to be hiked to at least Rs 5 lakh. This will add momentum to housing demand, particularly in the affordable segment,” he said. Now, in case you buy another property with another home loan, you will get deductions on the interest payments.

If the housing loan is availed by two or more persons, each of them is eligible to claim a deduction on the interest paid up to Rs.2 lakh each. Tax can be deducted on the principal paid as well for an amount up to Rs.1.5 lakhs each. However, all the applicants should also be co-owners of the property in order to claim this deduction. Therefore, a joint home loan can give you greater tax benefits. If you rent out your second home for a particular amount, the amount earned as rent will be considered as the annual value of the property. A standard deduction is allowed for the property which is let out and in case you are repaying home loan interest, you will save on that as well.

However, in the case of the latter, since it is considered as ‘let-out’ or rented, the income generated through the rent will be subject to tax. This means that your rental income will be taxable under the ‘Income from house property’ head. Availing of a second Home Loan allows you tax benefits on the principal portion of your Home Loan repayment. You can claim a deduction of up to Rs.1.50 Lakh under section 80C of the Income Tax Act, 1961.

To understand the tax benefits of a second Home Loan, read on. Buying a second home makes for a sound investment choice, and with the help of a Home Loan, this move is made easier and tax effective. The Income Tax Act has special provisions in place to incentivize the purchase of a second residential property by allowing deductions on the second Home Loan. “Such a move would have more homes qualifying as affordable housing, and many more homebuyers would be able to avail the current benefits like reduced GST at 1% without ITC, and other government subsidies,” Puri said.

Go to IRS.gov/Account to securely access information about your federal tax account. Go to IRS.gov/Forms to view, download, or print all the forms, instructions, and publications you may need. Form 9000, Alternative Media Preference, or Form 9000 allows you to elect to receive certain types of written correspondence in the following formats. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL.

You can build your dream home exactly how you want with the help of home loans for under-construction properties provided... Furthermore, the property cannot be sold during 5 years of residency in order to permit this rebate. If not, the prior deduction will be taken out from your earnings during the year of sales. With the reduction you are entitled to claim on your home property income, a reduction in 5 equal monthly instalments starting with the year the house construction is done or acquired is authorised. By continuing to use the site, you are accepting the bank's privacy policy.

No comments:

Post a Comment